Karachi December 27, 2021: Anti Dumping duties imposed on imports of Polyvinyl Chloride Resin (PVC) is set to expire on 12 June 2022. Government has imposed duty in 2017 to stop dumping of PVC resin by Korean and Chinese companies into Pakistan. However, due to increase in landed cost for imported PVC domestic PVC manufacturer has increased its prices significantly that resulted in higher construction cost. Engro Polymer is currently selling PVC resin around PKR400,000 per ton that is approximately USD2,250 per ton that is 68 percent higher than current international price of USD1,330 per ton.

On 13 June 2017, the Pakistani National Tariff Commission imposed a provisional antidumping duty on imports of the subject good from China, Chinese Taipei, the Republic of Korea and Thailand. The rate of duty on imports from China is between 31.98% and 37.43% depending on the company. The rate of duty on imports from Thailand is 36.52%. The rate of duty on imports from Chinese Taipei is 42.41%. The rate of duty on imports from the Republic of Korea is 11.18%. NTC has also imposed Anti Dumping duty in 2005 but that was ended after the specified period and no extension is given to local manufacturers.

A L S O || R E A D

Treet, Tele, GGGL among 37 others Become Sharia Compliant: PSX

The antidumping investigation was initiated on 29 November 2016. The products subject to investigation are classified under the following HS code subheading: 3904.10.90. This investigation follows the application lodged on 14 October 2016 by Engro Polymer & Chemicals Ltd.

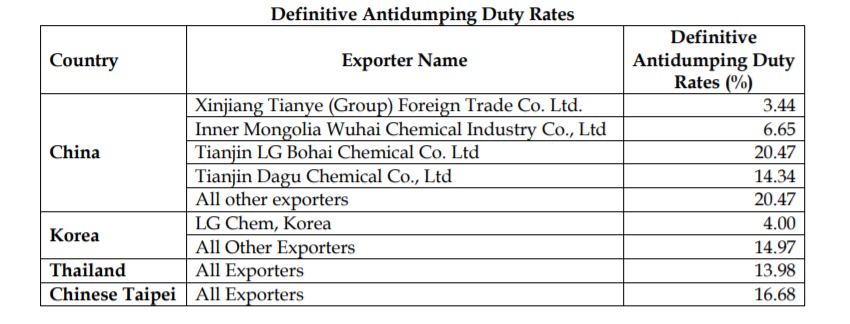

On 25 April 2018, the Pakistani National Tariff Commission imposed a definitive duty on imports of polyvinyl chloride from China, the Republic of Korea, Chinese Taipei and Thailand. The rate of duty on imports from the Republic of Korea is 4.00% or 14.97% of the C&F value depending on the company. The rate of duty on imports from Chinese Taipei is 16.68% of the C&F value. The rate of duty on imports from Thailand is 13.98% of the C&F value.

The rate of duty on imports from China is between 3.44% and 20.47% of the C&F value depending on the company. The duty is in force for a period of five years from 13 June 2018, i.e. on the date provisional duties were imposed. Given that the rate of provisional duties is higher than the definitive duties imposed, companies may apply for refunds equal to the difference between the two antidumping duty levels.

Five exporters/producers i.e. Xinjiang Tianye (Group) Foreign Trade Co. Ltd, China, Inner Mongolia Wuhai Chemical Industry Co., Ltd., China, Tianjin LG Bohai Chemical Co. Ltd., China, Tianjin Dagu Chemical Co., Ltd, China and LG Corporation, Korea from the Exporting Countries provided complete data/information on Exporter’s Questionnaire for the purposes of this investigation.

A L S O || R E A D

New Refinery Policy Being Finalised To Shift Refineries Away From Furnace Oil: Hammad Azhar

Normal value and export price of the investigated product for these five exporters/ producers have been determined in accordance with relevant provisions of the Act, on the basis of the information provided by these exporters/producers in response to the Commission’s Questionnaire and verified during the verification visit.

Accordingly, the Commission has worked out individual dumping margins for these exporters/producers. However, residual dumping margins have been determined for all other non-cooperating exporters/producers from the Exporting Countries.

In this final determination the Commission has determined that PVC is imported from the Exporting Countries at dumped prices and is consequently causing material injury to the domestic injury. In order to prevent material injury to the domestic industry, the Commission, pursuant to powers conferred under Section 50 of the Act, has decided to impose definitive anti-dumping duties at the rates mentioned below on C&F value in ad val. terms on imports of PVC imported from the Exporting Countries under PCT Heading No. 3904.1090, for a period of five years with effect from June 13, 2017.