New York October 30 2022: An equity valuations signal suggests things are about to get a lot worse for emerging-market investors before getting better.

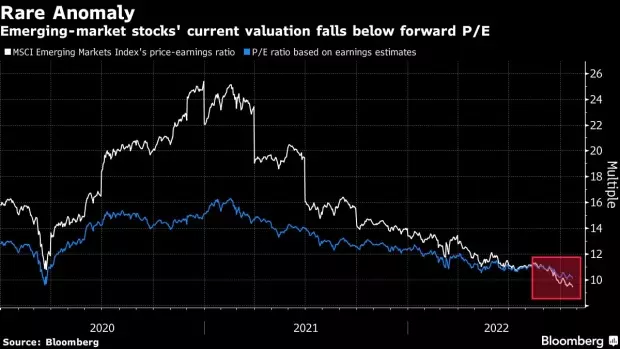

The price-earnings ratio of the benchmark MSCI Emerging Markets Index, based on trailing 12-month profits, has fallen below its price-earnings ratio based on estimated earnings for the next 12 months, showing that analysts expect earnings to fall faster in the future than currently.

“This is probably telling us that we are at an inflection point — a reflection of the fact that yields have risen so fast at a time when recession angst is increasingly concerning investors,” said Simon Quijano-Evans, the chief economist at Gemcorp Capital Management Ltd. in London. “Roughly speaking, for emerging-market earnings estimates to increase again, we need to see a calming in Federal Reserve hawkishness and a calming in the US dollar.”

For the most part, forward valuation ratios on stocks are lower than trailing ones because corporate profits — the denominator in the P/E ratio — are expected to grow. Even when earnings don’t grow in real terms, inflation boosts the estimates. Also, both types of valuations typically rise and fall together, as they are driven by the same market sentiment.

Analysts have reduced their average projections for profit at emerging-market companies by almost 16% this year, even though actual earnings have fallen only 3.8%. This has pushed trailing P/E to 9.55 times compared with the forward P/E of 10.1 times.

“Earnings estimates in emerging markets are under pressure from weaker global demand and input cost inflation which is harder to pass on in that weaker demand environment,” said Hasnain Malik, a strategist at Tellimer in Dubai. “Banks, which have entered this downturn with low consumer exposure and strong balance sheets, may be relatively resilient.”

The MSCI EM Index has tumbled 31% this year so far, underperforming its developed-nation counterpart which is down 18%, as the strong dollar, stubborn inflation and slowing growth lessen the appeal of developing-nation equities. Earnings season is heating up globally, with about 687 of the 1193 companies in the index having reported earnings so far, and 46% of them disappointing, according to data compiled by Bloomberg.

Earnings revisions in emerging markets would see a “sharp improvement” if the dollar peaks soon, according to Credit Suisse Group AG strategists led by Andrew Garthwaite who said a consolidation in the greenback will last for long. Global emerging-market funds are the best performers when the dollar weakens, they wrote in a note published on Friday.

Crisis Flashback

The last time the multiples phenomenon happened in October 2008, stocks halted the financial-crisis rout and remained choppy for another five months. They began a more than 150% rally in March 2009 that lasted until May 2011.

Money managers may debate whether the valuation anomaly could act as an indicator of markets bottoming out just like it did in 2008. However, they will be sobered by the lack of Fed stimulus now, compared with the last time when the central bank began an almost $8 trillion balance-sheet expansion.

“Today is very different than 2008. In 2008, materials and energy represented almost 30% of the index. Today, that number is closer to 14%,” Malcolm Dorson, a portfolio manager at Mirae Asset Global Investments in New York. Emerging markets are now more diversified “and better positioned to benefit from potential changes in interest rate policies.”

Central banks are unlikely to have a change of heart anytime soon with inflation still above the Fed target while the US jobs market remains strong. Even in emerging markets like South Africa, slowing prices aren’t likely to be enough to sway the monetary policy regulator from raising interest rates.