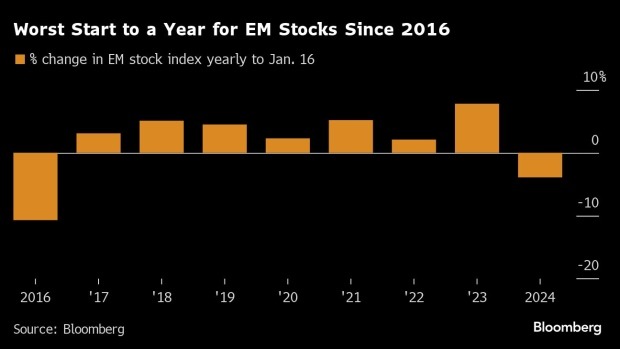

London January 16 2024: Emerging-market stocks have dropped in the first half of January, something that hasn’t happened since 2016.

Sentiment has taken a knock from growing uncertainty about when the Federal Reserve will begin to loosen monetary policy, with traders keenly awaiting a speech by Fed Governor Christopher Waller later Tuesday for insights. Meanwhile, investors are scrambling to price a host of geopolitical events from the Middle East to the US, where markets are weighing a potential return of Donald Trump to the White House.

MSCI Inc.’s index of developing-nation stocks slumped 1.2% on Tuesday, the most in almost two weeks, to trade at its lowest since Dec. 14 and extending its January declines to 4%. The currency index was led lower by South Korea’s won and the rand as a gauge for dollar strength rose to a one-month high.

The last two comparable bad starts to a year have preceded major emerging-market rallies.

In 2016, the January slump followed the first Fed rate hike in almost a decade. Higher US rates sparked a brief capital flight from riskier assets, leading to an 11% plunge by mid-January of 2016. However, things soon turned around as investors chased cheaper valuations, and EM stocks began a two-year, $8.3 trillion rally.

Something similar happened in 2009. The Fed dropped benchmark interest rates to near zero in December 2008, but investors fretted over the lingering effects of the global financial crisis and continued to dump emerging-market stocks well into January. Months later, as the US began a bull market, sentiment toward EM improved too, driving the MSCI gauge 75% higher over 2009.

Easing Volatility Underpins Case for Emerging-Market Rebound

Developments that are top of mind for investors Tuesday include attacks on ships in the Red Sea. Houthi militants hit a US-owned commercial vessel with a ballistic missile on Monday, underscoring warnings the vital waterway remains too risky.

Elsewhere, China is considering 1 trillion yuan ($139 billion) of new debt issuance under a so-called special sovereign bond plan, only the fourth such sale in the past 26 years, as authorities seek more money to finance intensifying efforts to shore up the world’s second-largest economy.

The proposal under discussion by senior policymakers would involve the sale of ultra-long sovereign bonds to fund projects related to food, energy, supply chains and urbanization, people familiar with the matter said.

Meanwhile, central and eastern European bond investors who reaped outsize returns in the past year are bracing for political turmoil and overspending, potentially tempering gains in 2024.

Slowing inflation and interest rate cuts have boosted local-currency debt in the area spanning from Poland to the Balkans, capping a year of advances in 2023. But a busy election season and some of the widest budget deficits in the European Union are set to complicate the picture for the coming year.