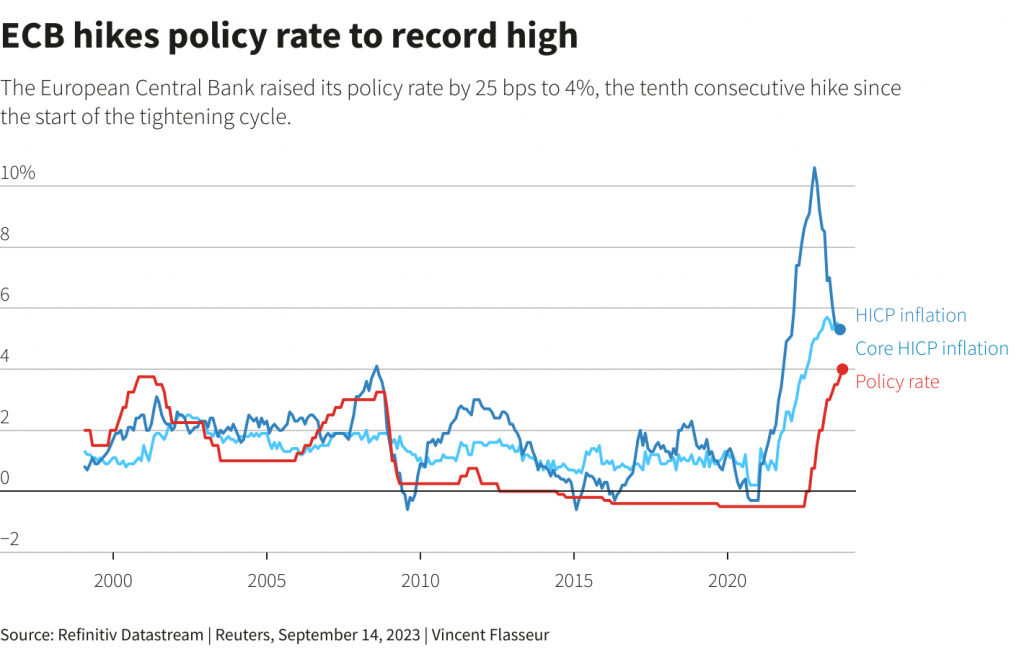

Frankfurt September 14 2023: Governing Council of European Central Bank (ECB) today decided to raise key ECB interest rates by 25 basis points and signals this to be last hike as inflation continues to decline.

Inflation continues to decline but is still expected to remain too high for too long, the Governing Council notes. The Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner.

The rate increase today reflects the Governing Council’s assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

he September ECB staff macroeconomic projections for the euro area see average inflation at 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025. This is an upward revision for 2023 and 2024 and a downward revision for 2025. The upward revision for 2023 and 2024 mainly reflects a higher path for energy prices. Underlying price pressures remain high, even though most indicators have started to ease. ECB staff have slightly revised down the projected path for inflation excluding energy and food, to an average of 5.1% in 2023, 2.9% in 2024 and 2.2% in 2025. The Governing Council’s past interest rate increases continue to be transmitted forcefully. Financing conditions have tightened further and are increasingly dampening demand, which is an important factor in bringing inflation back to target. With the increasing impact of this tightening on domestic demand and the weakening international trade environment, ECB staff have lowered their economic growth projections significantly. They now expect the euro area economy to expand by 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025.

Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary. The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction. In particular, the Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Key ECB interest rates

The Governing Council decided to raise the three key ECB interest rates by 25 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 4.50%, 4.75% and 4.00% respectively, with effect from 20 September 2023.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The APP portfolio is declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

Refinancing operations

As banks are repaying the amounts borrowed under the targeted longer-term refinancing operations, the Governing Council will regularly assess how targeted lending operations and their ongoing repayment are contributing to its monetary policy stance.