Beijing August 9 2024: China’s consumer prices rose more than expected in July, largely due to seasonal factors like weather, leaving intact concern over sluggish domestic demand and boosting the case for more policy support.

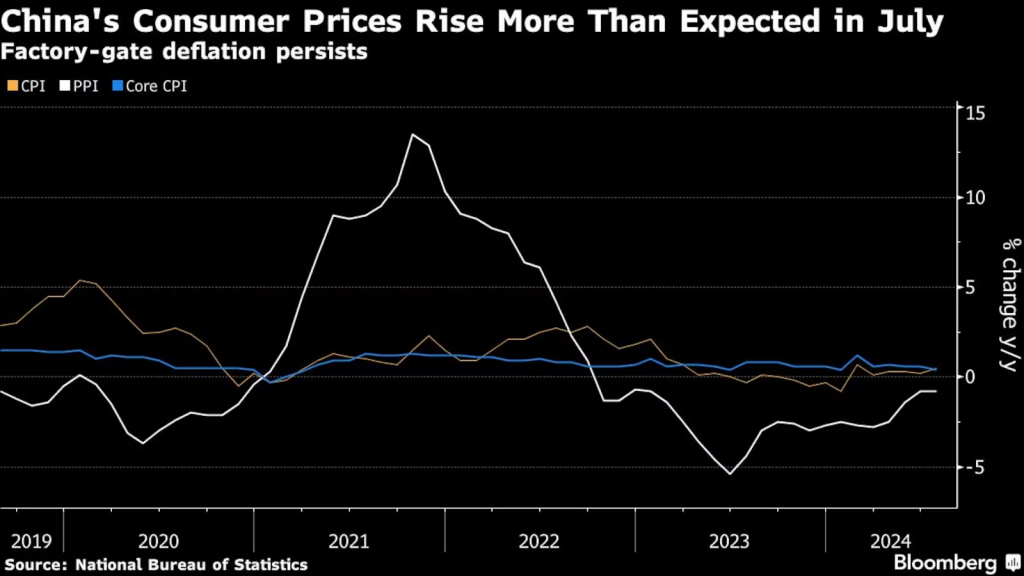

The consumer price index climbed 0.5% from a year earlier, exceeding the 0.3% estimate in a Bloomberg survey, data from the National Bureau of Statistics on Friday show. Excluding volatile food and energy costs, core CPI rose 0.4%, the least since January, indicating lingering weakness in overall demand.

“Unfavorable weather conditions and the low base for pork prices from last year, instead of rising domestic demand, were the major drivers,” said Serena Zhou, senior China economist at Mizuho Securities Asia Ltd. “We anticipate coordinated fiscal and monetary support in the second half of 2024.”

China’s economy is battling deflationary pressures, with one measure showing the longest streak of falling consumer prices since 1999. Weak consumption and investment demand have led to intense price wars in sectors including electric vehicles and solar, hurting companies’ profits and making consumers even more inclined to delay purchases as they expect costs to keep dropping.

Data on Friday also showed factory-gate prices extending a deflationary run that began in late 2022. The producer price index declined 0.8% from a year earlier, in line with the drop in June.

Dong Lijuan, chief statistician at the NBS, attributed the rise in the headline CPI figure to “a continued recovery in consumption demand.” Yet she also noted that high temperatures and rain in some regions had an impact on prices.

Adverse weather pushed up vegetable and egg prices in July, reversing losses the previous month. That helped food prices snap a year-long run of contraction, which has been a major drag on consumer inflation. The fastest surge in pork prices since 2022, thanks to a low base from last year, also contributed to the increase.

Among non-food items, the prices of cars, smart phones and home appliances led the declines, reflecting price wars and persistent spillover impact from a housing downturn.

The offshore yuan ticked higher after the data, while China’s bond futures dipped. The benchmark 10-year yield edged up a basis point to 2.19% in a week where state banks have been actively selling the security to guide yields higher.

Chinese stocks advanced in early trading, with the CSI 300 Index climbing as much as 0.7%, and the Hang Seng China Enterprises Index adding nearly 2.4%.

Reviving domestic demand is increasingly important as exports — a rare bright spot in the economy this year — unexpectedly slowed in July, signaling a cooling of global demand. That is imperiling Beijing’s goal of around 5% growth for 2024.

China’s Politburo, the ruling Communist Party’s top decision-makers, vowed to make boosting consumer spending a greater policy focus in a recent meeting. The government rolled out a 20-step action plan to encourage more spending on services, though it offered little in the way of financial incentives to rev up domestic demand.

Economists are calling for more stimulus from Beijing to address the weak domestic demand. Local government bonds and subsidies could play a pivotal role in bolstering consumption and mitigating risks associated with their debt and the property downturn, according to Mizuho’s Zhou.

The People’s Bank of China is also expected to have more room to cut interest rates this year as traders price in a more aggressive path of rate cuts by the US Federal Reserve. Some economists see a total of three in China in 2024 — easing unseen in years.

“Conditions are in place to see inflation trend a little higher in the coming months but it should not impede further monetary easing,” Lynn Song, chief economist for greater China at ING Groep NV, said in a note. “With low inflation and weak credit activity, domestic factors continue to favor further monetary policy easing.”