Beijing November 17 2022: Chinese regulators asked banks to report on their ability to meet short-term obligations after a rapid selloff in bonds triggered a flood of investor withdrawals from fixed-income products, according to people familiar with the matter.

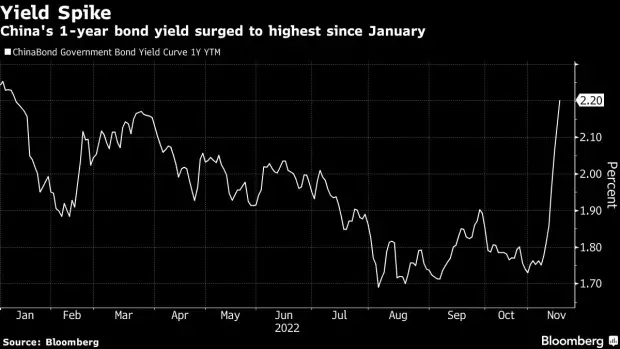

The unscheduled regulatory queries coincided with the biggest slump in China’s short-term government debt since mid-2020. The rout — spurred by a shift toward riskier assets including stocks — prompted retail investors to pull money from wealth-management products, fueling a spiral of price declines and accelerating withdrawals. Losses also spread to top-rated corporate bonds, stoking a record surge in yields this week.

Several banks have issued public statements to reassure investors that the turmoil will be contained, while the People’s Bank of China nearly doubled the size of its financial-system cash injections through open-market operations on Wednesday. One person familiar with the matter who has regulatory oversight said liquidity conditions are likely to stabilize in a few days.

China’s biggest banks are widely thought to have plentiful access to capital, but the outsized price swings and withdrawals have raised the risk of short-term funding mismatches. Fixed-income products that offer daily pricing and liquidity are a relatively new in China: Investors had long been subject to longer lockups — and guaranteed returns — until a series of reforms were enacted to reduce moral hazard in the financial system.

This week’s turbulence is an unexpected side-effect of growing economic optimism. China’s $10 trillion stock market has soared in recent days after President Xi Jinping’s government eased some of its strict Covid Zero policies, rolled out a rescue package for the property sector and moved to cool tensions with the US and other western nations. With money flowing into shares and other economically sensitive investments, safe haven bets on government bonds have suffered.

At least five lenders have reported their liquidity conditions and potential risks to the PBOC and China Banking and Insurance Regulatory Commission in recent days, including their plans to meet redemptions from investors, people familiar with the matter said, asking not to be identified discussing internal information.

The PBOC and CBIRC didn’t immediately respond to requests for comment.

“The slump in bond market lately has caused some retreat in mark-to-market value in some of the wealth management products,” Bank of China Ltd.’s wealth management unit said in a statement on Wednesday. “The PBOC’s monetary easing has trailed expectations, which tightened liquidity condition and pushed money market rates higher, while the adjustments in property and Covid policies to support economic growth have also lifted sentiment.”

Bank of China said it would contain losses and actively pursue relatively secure investments. Industrial Bank Co. and China Zheshang Bank Co. also sent similar posts on their official WeChat accounts, encouraging investors to “buy at lows” and position for longer-term return after the sharp losses in bond market.

The PBOC injected a net 123 billion yuan ($17.3 billion) of seven-day liquidity via its open-market operations on Wednesday. The central bank said in a statement earlier this week that they it more than 1 trillion yuan in liquidity this month through a combination of short-, medium- and long-term policy tools. That gave the debt market a shot in the arm but the optimism was short-lived.

The yield on China’s one-year note has jumped about 40 basis points in the past five days to 2.25%, the highest since January. In the worst rout since 2016, China’s 10-year yield jumped 10 basis points in one day this week.

Banks’ wealth management products have drawn increasing scrutiny from regulators in past few years, amid concern about a host of risks from implicit guarantees and leverage, to duration mismatches and a lack of transparency around where the money is invested.

Beijing’s most recent crackdown on shadow banking took aim at the nation’s more than $1 trillion of opaque WMPs last year, barring lenders and wealth managers from using the money pooled from cash management tools to buy long-term debt or bonds rated below AA+.

Outstanding cash management products at China’s banks amounted to 9.78 trillion yuan as of mid-October, according to research from Citic Securities Co. Bond investments accounted for 68% of assets in WMPs at the end of June, according to official data.

More than 10,000 of the 30,000 outstanding WMP products as of Wednesday have recorded a paper loss in the past week, Shanghai-based consultancy Financial Regulation & Law wrote in a report.