Karachi September 5 2023: The aggregate amount of CGT arising on disposal of shares at Pakistan Stock Exchange for the period

July 1, 2023 to July 31, 2023, would be collected on Tuesday September 12, 2023 through respective settling banks of the Clearing Members.

All Clearing Members are hereby requested to ensure requisite amount in their respective settling bank’s account. Necessary details and reports for the said period have already been made available in the CGT System.

Further, the aggregate amount of CGT arising on trading of future commodity contracts at Pakistan Mercantile Exchange for the period July 1, 2023 to July 31, 2023 would also be collected from the Pakistan Mercantile Exchange on Tuesday September 12, 2023. Necessary details and reports for the said period have already been made available.

Moreover, the aggregate amount of CGT arising on redemption of units of open end mutual funds have

also been finalized for the period July 1, 2023 to July 31, 2023. Necessary details and reports have already been made available in the CGT System.

Clearing Members and Pakistan Mercantile Exchange are hereby requested to verify the investor wise details of capital gain or loss and tax thereon, if any, through reports/downloads. Please note that, in case of none or partial collection of CGT, necessary action would be taken in accordance with the Rules and NCCPL Regulations.

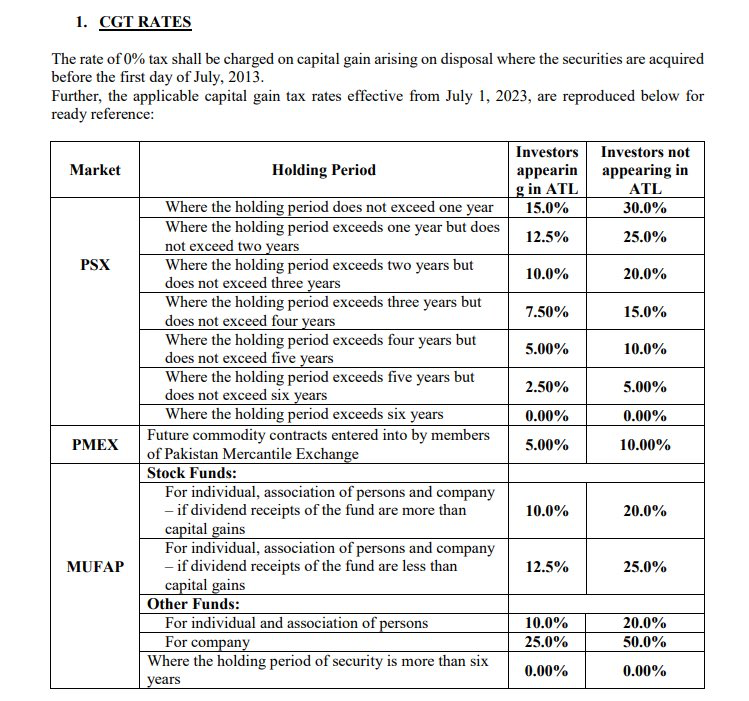

Capital Gain Tax Rate

The rate of 0% tax shall be charged on capital gain arising on disposal where the securities are acquired before the first day of July, 2013.

Further, the applicable capital gain tax rates effective from July 1, 2023, are reproduced below for ready reference:

Except for PMEX and MUFAP:

i. The reduced rates of tax on capital gain arising on disposal shall apply where the securities are acquired on or after the first day of July, 2022; and

ii. The rate of 12.5% tax shall be charged on capital gain arising on disposal where the securities are acquired on or after the first day of July, 2013 but on or before the 30th day of June, 2022.

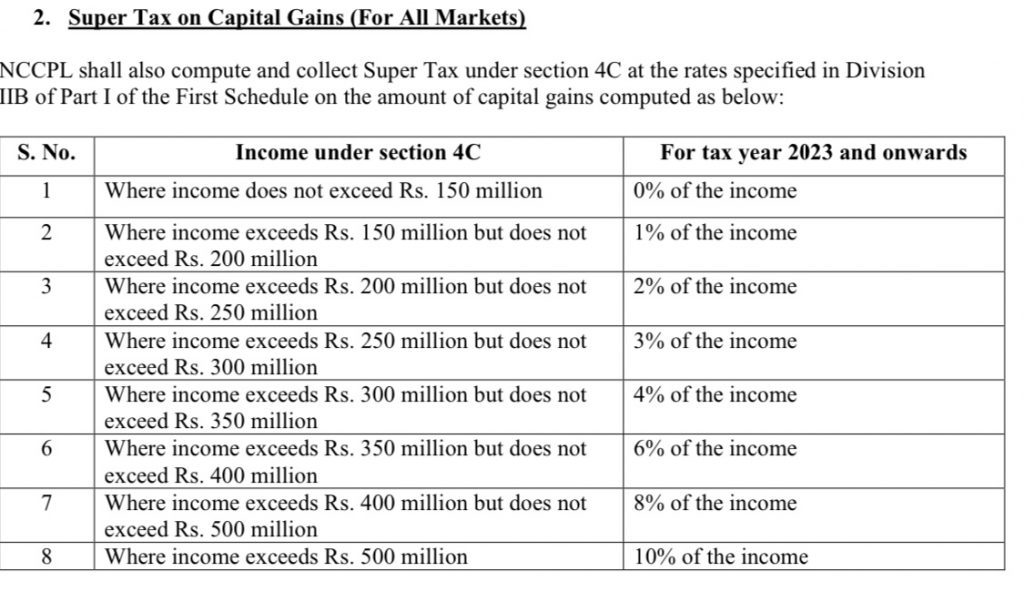

Super Tax on Capital Gains (For All Markets)

NCCPL shall also compute and collect Super Tax under section 4C at the rates specified in Division IIB of Part I of the First Schedule on the amount of capital gains computed as below:

Super tax will be computed and collected if net capital gain of an investor exceeds above mentioned threshold. If net capital gain is further increased or decreased in following months, super tax will be re-computed and differential tax amount will be collected or refunded.