London February 2 2023: The Bank of England signaled the fastest pace of interest-rate hikes in three decades may be drawing to a close after it raised its benchmark lending rate a half point.

Policy makers led by Governor Andrew Bailey voted 7-2 to raise the benchmark lending rate to 4%, the highest since 2008. The majority said strong pay growth and an ongoing shortage of workers were driving price pressures in the economy.

But the BOE’s latest forecasts showed that inflation is likely to fall sharply this year to around 4% from a four-decade high of 11.1% last October, and it could be below the 2% target in 2024. Those findings suggest that policy makers may not need to raise rates much more, although Bailey maintained the risks are tilted toward the upside.

“We have seen a turning of the corner, but it is very early days, and the risks are very large,” Bailey said at a press conference after the decision Thursday. He added that it’s “too soon to declare victory. Inflationary pressures are still there” and the BOE would have to be “absolutely sure” before shifting its stance.

The BOE has underestimated inflation in the past and will not claim the battle is won until prices are falling in line with its outlook. Bailey said the bank needs pay and services inflation, which has hit a 30-year high of 6.8%, to ease and he added that the risks are skewed more strongly to the upside than at any time on record.

“It is clear that the central bank feels it is coming to the end of its hiking cycle,” said Jamie Niven, a fund manager at Candriam. Sterling fell as much as 0.9% to $1.2265. The yield on 10-year gilts tumbled 23 basis points to 3.08%, heading for its biggest slide since October.

Money markets trimmed bets on how high the BOE would hike rates, with traders now seeing the peak around 4.35% versus 4.4% before the decision. After that is reached in the middle of 2023, they are pricing a quarter-point cut by year-end with more in 2024.

The BOE did not lean against the market path for rates, which imply two quarter point rate rises may still be needed. Although its central forecast was for inflation to fall below 1% in two years’ time using those assumptions, the BOE said that “an inflation forecast that took into account these upside risks was judged to be much closer to the 2% target.”

Bailey pointed out that the bank’s projections were inherently uncertain, subject to volatile energy and commodity markets, and that it has previously underestimated pay growth. Deputy Governor Dave Ramsden also noted that had the BOE not changed the way it incorporates future energy prices into the forecast, its inflation forecast would be a percentage point higher.

But in a clear sign the end of the rate-rise cycle may be nearing, the monetary policy committee dropped earlier guidance that it was willing to respond “forcefully” to inflation, saying instead that “if there were to be evidence of more persistent pressure, then further tightening in monetary policy would be required.”

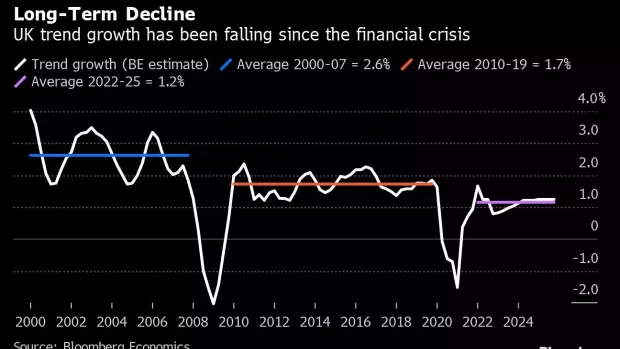

The BOE may also be reluctant to raise rates into a recession. It believes the UK is now in recession, with output due to contract almost 1% over five quarters. The projections imply 500,000 job losses over the next three years. Weak potential growth means that output will not get back to pre-pandemic levels until 2026.

For Silvana Tenreyro and Swati Dhingra, impact of past increases and slowing growth would be enough to rein in inflation. They voted to leave rates unchanged. Catherine Mann, who voted for a 75 basis-point increase last time, joined Bailey and the majority of MPC members in endorsing the half-point hike.