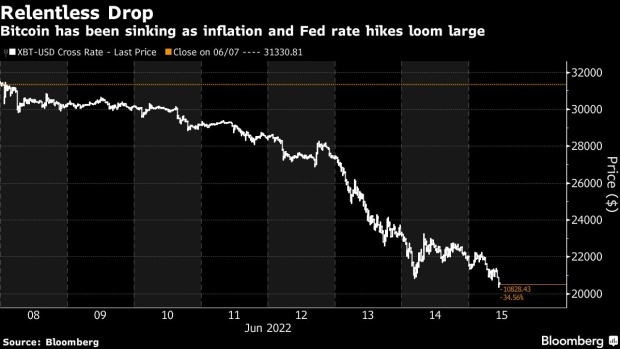

London June 15 2022: Bitcoin prices tumbled once again, driving the token to the brink of $20,000 on evidence of deepening stress within the crypto industry.

The largest cryptocurrency sank 8% to $20,180, the lowest level since December 2020. Bitcoin has fallen for nine days, the longest losing streak since 2014. Losses continued to be widespread, with Ether plunging 10% to $1,062.

The turmoil in the industry is snowballing as traders bail on the asset class that has represented the height of speculative investing and easy money. Now with pricing continuing to dive, there are more predictions that losses will accelerate as key levels are broken.

“If these levels break, $20,000 Bitcoin and $1,000 Ether, we can expect massive sell pressure in the spot markets as dealers hedge themselves,” BitMEX co-founder Arthur Hayes said in a tweet.

Fresh apprehension in the market was triggered on Wednesday after a founder of Three Arrows Capital, an influential hedge fund that has been liquidating crypto holdings, posted a vague tweet. “We are in the process of communicating with relevant parties and fully committed to working this out,” former Credit Suisse Group AG trader Zhu Su tweeted from his verified account, without providing further details.

Crypto Hedge Fund’s Tweet Fuels Speculation Over Losses

Crypto markets had already witnessed two high-profile blowups since early May, roiling an asset class that was already under pressure from tightening monetary policy. First, the Terra decentralized-finance ecosystem collapsed when an algorithmic stablecoin that was a key part of it crumbled from its dollar peg. About a month later, crypto lender Celsius froze withdrawals on a platform where it offered high returns, citing a need to “stabilize liquidity.”

The total market cap of cryptocurrencies has dropped to $925 billion, according to CoinGecko, from a high above $3 trillion in November.