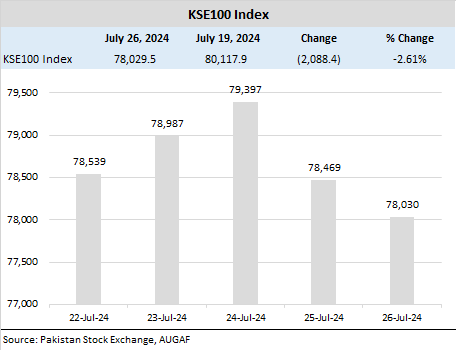

Karachi July 26 2024: During the week ending July 26, 2024, the KSE100 index declined by 2.61% or 2,088 points. This drop was primarily attributed to political turmoil in the country, despite a recent USD 7.0 billion staff-level agreement between the IMF and Pakistan and expectations of a rate cut in the upcoming monetary policy.

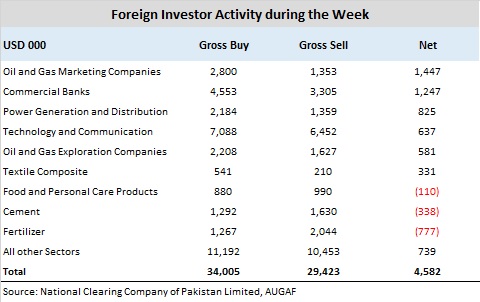

Foreign investors continued buying, with a net purchase of USD 4,582K this week, compared to USD 9,328K the previous week. Significant foreign investments were seen in Oil and Gas Marketing Companies (USD 1,447K), Commercial Banks (USD 1,247K), Power Generation (USD 825K), and Technology (USD 637K). The Fertilizer sector experienced the highest net selling at USD 777K, followed by the Cement sector with USD 338K in net selling.

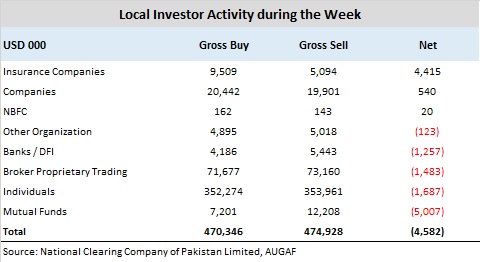

On the local front, Mutual Funds were the largest net sellers at USD 5,007K, followed by Individuals (USD 1,687K), Brokers (USD 1,483K), and Banks (USD 1,257K). Conversely, Insurance companies were the net buyers, with purchases totaling USD 4,415K.

Average trading volumes for the week were 337 million shares, a decrease of 27% WoW, while the average traded value was USD 56 million, down 42% WoW.

According to a report by Arif Habib Limited, the market is expected to remain positive due to the anticipated rate cut in the upcoming monetary policy meeting scheduled for Monday. Additionally, the continuation of the results season next week is likely to sustain the positive momentum.