Washington DC June 13 2023: Libya has been mired in conflict and political uncertainty since the fall of the Ghaddafi regime in 2011. Until recently, the country’s fragmentation hampered policymaking and the collection of key economic data. However, the country has made significant efforts to move forward and overcome the economic challenges brought by political conflict.

As Libya paves the way for its economic recovery, it has made recent improvements in data collection, sharing, and transparency that have enabled the IMF to resume its surveillance after a decade-long hiatus.

Foundation for recovery

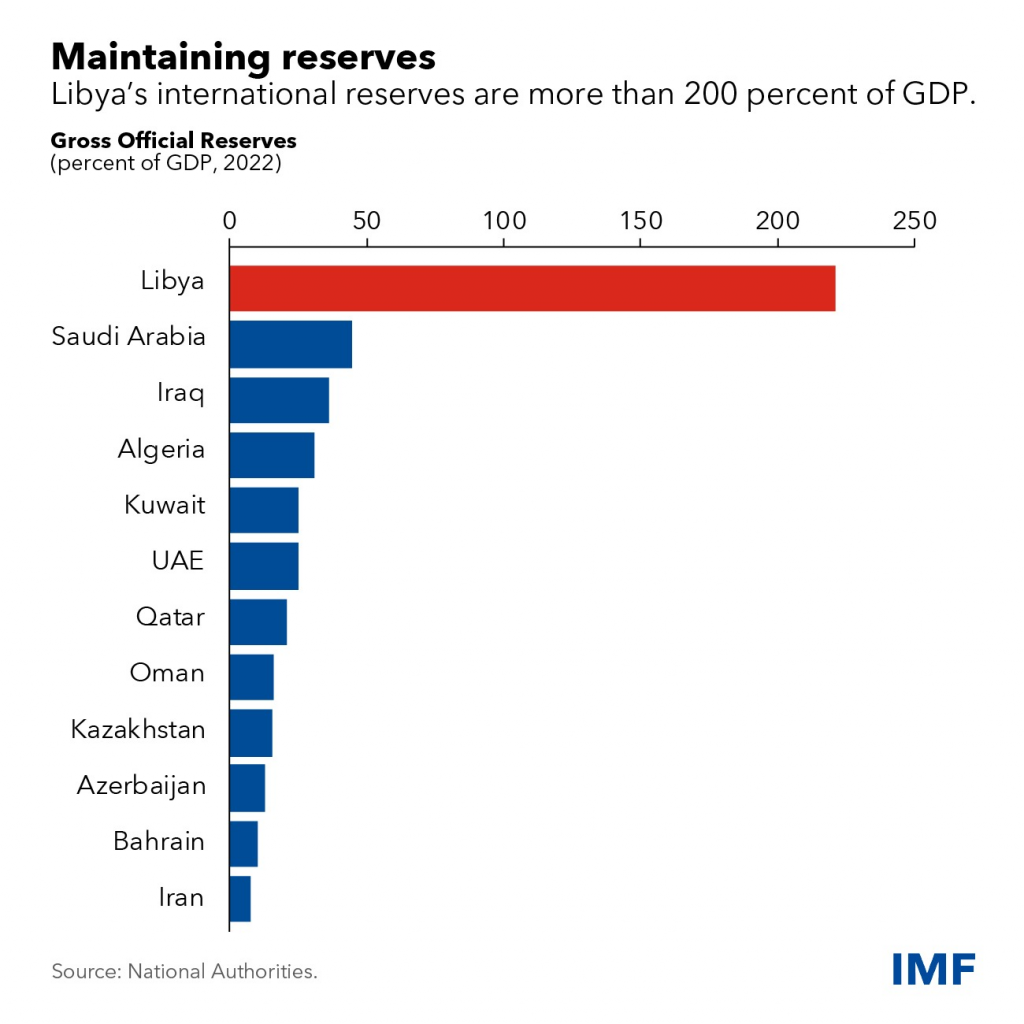

As part of its first economic health check in a decade, the IMF identified key strengths and opportunities that will support Libya’s recovery. The Central Bank of Libya has maintained a large stock of international reserves, supported by a fixed exchange rate, capital controls, and various temporary arrangements. This played an important role in helping the country overcome the exceptional swings in oil production and revenues that occurred post-revolution.

With vast oil and gas reserves, Libya has one of the highest GDP per capita levels in Africa. Hydrocarbon production will continue to be a critical part of Libya’s economic future, making up around 95 percent of exports and government revenue. We project that it will grow by about 15 percent in 2023, following an increase in activity after an oil blockade limited production in 2022. However, the key challenge will be to diversify away from oil and gas while fostering stronger and more inclusive private sector growth.

The path forward

Libya needs an economic strategy that clearly articulates a way forward for the nation. This would be an opportunity to rally the public behind a plan that optimizes the use of oil revenue to diversify the economy and break away from the Ghaddafi-era policies that fostered rent-seeking behavior, corruption, and government opacity.

The success of reforms will depend on achieving a stable political and security environment and developing institutional capacity. Structural reform efforts should focus on strengthening institutions and the rule of law. To guard against risks from lower oil revenues and a potential loss of reserves, the authorities should avoid spending more when the economy is doing well and save for times when the economy might slow down.

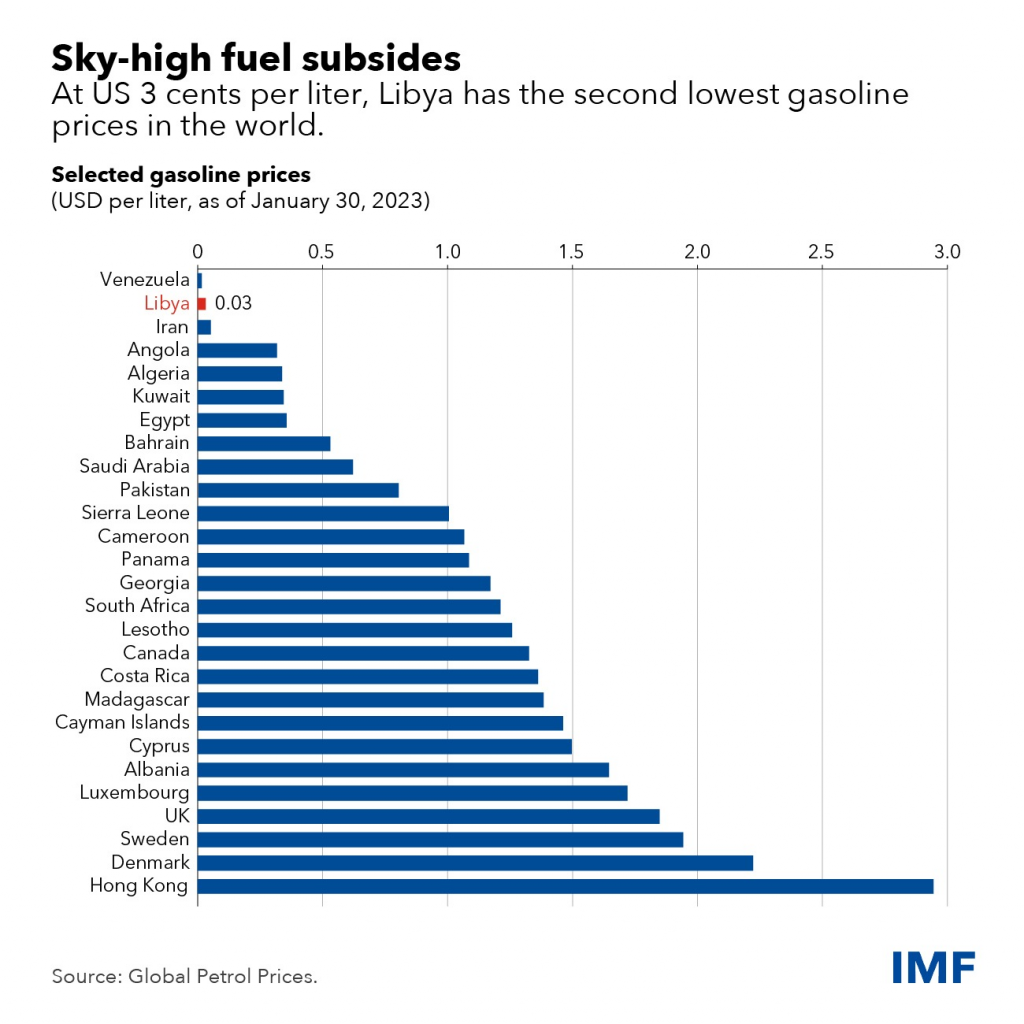

To this end, Libya urgently needs a transparent budget that reduces costs associated with high spending on public sector wages and subsidies. Government spending is dominated by public sector salaries, with around 2.2 million people—one-third of the population—notionally employed by the public sector. Subsidies and grants amount to around one quarter of spending and fuel subsidies are particularly problematic, with the domestic price of gasoline at US 3 cents per liter, the second lowest in the world.

As IMF surveillance of Libya resumes, we will continue to provide policy advice and support to help strengthen the economy and prepare for post-conflict rebuilding.