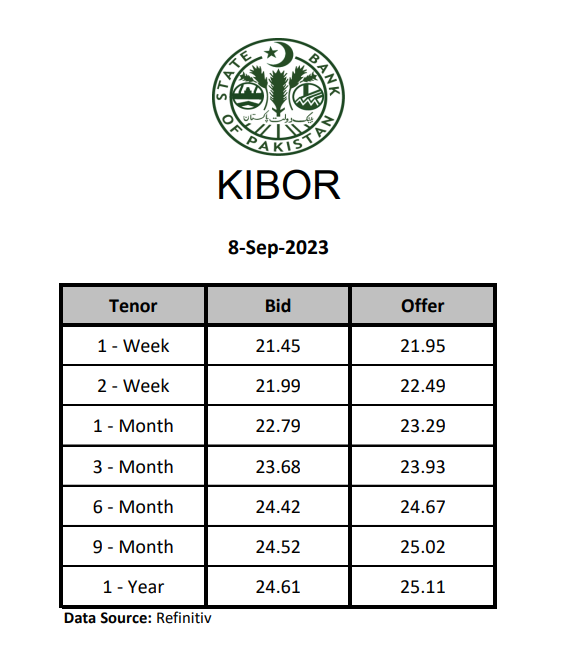

Karachi September 10 2023: Pakistan lending benchmark, 6-Month KIBOR, reaches an all-time high of 24.67 percent on 8th September 2023 on anticipation of rate hike.

On February 22 2023, SBP raised PKR 1,332 billion through the auction of market treasury bills at all-time high rates and 249 to 306 basis points above the policy rate of 22 percent, according to State Bank of Pakistan.

The cut-off yield for 3 Months, 6 Months and 12 Months paper settled at 24.499 percent, 24.787 percent and 25.068 percent, respectively. Cut-off yields increased by 162 basis points for 3 Month T-Bills and 213 basis point for 12 Months from previous auction.

“We expect the SBP to increase the policy rate by 150bps to 23.5 percent in this meeting as a precautionary measure to address the persistently high levels of inflation in the country” says Sana Tawfik an Economist at Arif Habib Limited in its research report.

“During 2MFY24, inflation remained alarmingly high, averaging around 27.8%. This ongoing inflationary trend is expected to persist, with our forecasts indicating an average inflation rate of ~28.5% until Dec’23, particularly following an expected peak in Sep’23.” the report added.

Appreciation in currency over the week and liquidity injection by State Bank of Pakistan at lower rates may cool down secondary market in the coming week before the MPC which is scheduled to be held on September 14th 2023.

On 8th of September State Bank of Pakistan injected liquidity of PKR 1,293 billion into the banking channels for a period of 77 days at 22.11 percent and PKR 126 billion for a period of 7 days at 22.15 percent.

Pakistani Rupee on Friday was strengthened by PKR 2.0 against the US dollar in the interbank trading to close at PKR 302.94 as central bank introduces structural reforms and government action against smuggling and hoarding of dollars. However, according to the Forex Association of Pakistan (FAP), the buying and selling rates of the dollar in the open market stood at Rs 302 and Rs 305 respectively. Pakistan Rupee Gains PKR 31 in Open Market during the week.