Karachi July 19 2023: The State Bank of Pakistan on Wednesday announced the Domestic Systemically Important Banks for the year 2023 under D-SIBs framework aimed at further strengthening risk management capacities and resilience against shocks.

According to a statement issued here, the central bank has designated National Bank of Pakistan (NBP), Habib Bank Limited (HBL) and United Bank Limited (UBL) as D-SIBs for the year 2023 after carrying out the annual assessment based on banks’ financials as of December 31, 2022 in line with D-SIBs framework.

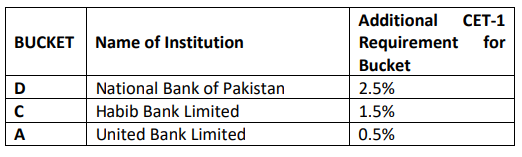

In addition to the implementation of the enhanced supervisory requirements, the designated banks have to follow additional Common Equity Tier-1 (CET-1) capital requirements according to the specified bucket.

The NBP has been assigned bucket D with 2.5 percent additional CET-1 requirement, the HBL has been placed in bucket C with 1.5 percent additional CET-1 requirement and UBL in bucket A with 0.5 percent additional CET-1 requirement.

The enhanced requirements aim to further strengthen the resilience of the systemically important banks against shocks and augment their risk management capacities, the SBP spokesperson informed.

Besides, branches of Global-Systemically Important Banks (G-SIBs) operating in Pakistan would also be required to hold additional CET-1 capital against their risk-weighted assets in Pakistan at the rate as applicable on the respective principal G-SIB, it added.

D-SIBs Framework notified in April 2018 by SBP is consistent with international standards and global best practices and takes into account the local dynamics, the statement said adding that the framework specifies the methodology for the identification and designation of D-SIBs, enhanced regulatory and supervisory requirements and implementation guidelines for D-SIBs.

Giving details of two steps process of identification of D-SIBs, the spokesperson stated that in the first step, sample D-SIBs were identified each year based on the quantitative and qualitative criteria while in the second step, D-SIBs were designated from amongst the sample D-SIBs based on institutions’ composite systemic score in terms of their size, interconnectedness, substitutability and complexity.