Beijing July 3 2023: China imposed restrictions on exporting two metals that are crucial to parts of the semiconductor, telecommunications and electric-vehicle industries in an escalation of the country’s tit-for-tat trade war on technology with the US and Europe.

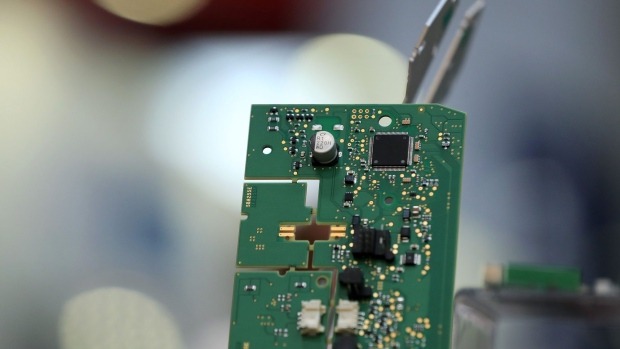

Gallium and germanium, along with their chemical compounds, will be subject to export controls meant to protect Chinese national security starting Aug. 1, China’s Ministry of Commerce said in a statement Monday. Exporters for the two metals will need to apply for licenses from the commerce ministry if they want to start or continue to ship them out of the country, and will be required to report details of the overseas buyers and their applications, it said.

China is battling for technological dominance in everything from quantum computing to artificial intelligence and chip manufacturing. The US has taken increasingly aggressive measures to keep China from gaining the upper-hand and has called upon allies in Europe and Asia to do the same, with some success. The export limits are also coming at a time when nations around the world are working to rid their supply chains of dependencies on overseas equipment.

Impact on the tech industry “depends on the stockpile of equipment on hand,” said Roger Entner, an analyst with Recon Analytics LLC. “It’s more of a muscle flexing for the next year or so. If it drags on, prices will go up.”

China is the dominant global producer of both metals that have applications for electric vehicle makers, the defense industry and displays. Gallium and germanium play a role in producing a number of compound semiconductors, which combine multiple elements to improve transmission speed and efficiency. China accounts for about 94% of the world’s gallium production, according to the UK Critical Minerals Intelligence Centre.

Still, the metals aren’t particularly rare or difficult to find, though China’s kept them cheap and they can be relatively high-cost to extract. Both metals are byproducts from processing other commodities such as coal and bauxite, the base for aluminum production. With restricted supply, higher prices could draw out production from elsewhere.

“When they stop suppressing the price, it suddenly becomes more viable to extract these metals in the West, then China again has an own-goal,” said Christopher Ecclestone, principle at Hallgarten & Co. “For a short while they get a higher price, but then China’s market dominance gets lost – the same thing has happened before in other things like antimony, tungsten and rare earths.”

Other countries that produce gallium include Japan, South Korea, Russia and Ukraine, according to the CRU Group, a metals industry intelligence provider. Germanium is also produced in Canada, Belgium, the US and Russia.

Shares of companies that make compound semiconductors, such as Wolfspeed Inc. and NXP Semiconductors NV, were little changed or traded higher when US exchanges opened on Monday. A representative for Wolfspeed didn’t immediately respond to requests for comment. A spokesperson for NXP had no immediate comment.

China’s move comes after the US and its allies stepped up rhetoric against the country in recent weeks. US President Joe Biden’s administration is planning to block sales of some chips used to run artificial-intelligence programs, people familiar with the matter said last week. The Chinese government earlier this year banned US chipmaker Micron Technology Inc.’s products from some of its critical sectors after saying it found “relatively serious” risks in a cybersecurity review.

The Dutch government announced on Friday measures that will prevent ASML Holding NV — a company with a near-monopoly on the machines needed to make the most advanced semiconductors — from selling some of its machines to China.