Karachi May 18 2023: State Bank of Pakistan disclosed mechanism for payment of mark-up subsidy and credit loss subsidy to banks/MFBs working as Executing Agencies (EAs) under Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS).

EAs are advised to submit their claims to Development Finance Support Department, SBP BSC, Karachi, as per instructions contained in the enclosed payment mechanism within 15 working days after the end of each Quarter.

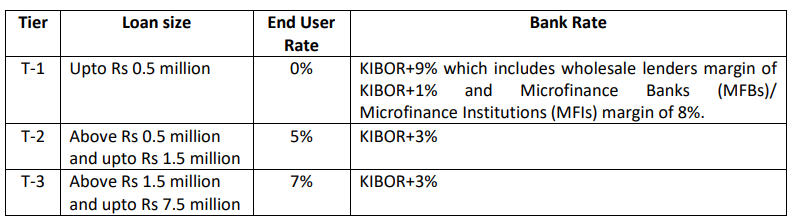

For Tier-1 loans, banks/DFIs, hereinafter referred to as Wholesale Lenders (WLs), will provide liquidity to MFBs/MFIs, collectively known as Microfinance Providers (MFPs) for onward lending to borrowers. Thus, MFPs will act as Executing Agencies (EAs) under Tier 1 loans, whereas for Tier 2 and Tier 3 loans, commercial and Islamic banks will act as EAs. GOP shall absorb the difference between the bank rate and end user rate as mark-up subsidy. Six months KIBOR offer will be used for calculation of mark-up subsidy with KIBOR to be reset bi-annually.

Besides mark-up subsidy, GOP will also bear credit losses (principal portion only) on the disbursed portfolio of the banks as follows:

- T-1 upto 50% which includes 40% for WLs on pari-passu basis and 10% for MFPs on first loss basis

- T-2 upto 25% in case of T2 loans

- T-3 upto 10% in case of T3 loans

Relevant regulations of SBP/ SECP will be applicable as per type of loan i.e. micro, agriculture and SME to determine its ‘loss’ classification on objective criteria (time based) or on subjective criteria.

Mechanism for Payment of mark-up Subsidy

Payment of mark-up subsidy to EAs shall be made through SBP’s operational arm viz Development Finance Support Department (DFSD), SBP BSC, Head Office, Karachi. In case of Micro, SME and agriculture loans, no mark-up subsidy will be paid after being classified as ‘Loss’ as per relevant regulations of SBP/SECP.

However, EAs can claim markup subsidy in subsequent months, if the status of non-performing loans (NPLs) is subsequently revised to “Regular”.

In case of Tier 1, EAs shall prepare and submit mark-up subsidy claims on the prescribed format to WLs within 05 working days after the end of respective quarter. WLs shall also prepare their mark-up subsidy claims on the SBP prescribed format. WLs shall submit claims to external audit firm to conduct audit of EAs and WLs claims. Thereafter, WLs shall submit audited claims (both EAs and WLs) along with the certificate by external audit firm relating to accuracy of subsidy & loan loss calculations to DFSD, SBP BSC within 15 working days after the end of respective quarter for payment of mark-up subsidy.

In case of Tier 2 & Tier 3, EAs shall submit mark-up subsidy claims on the prescribed format duly vetted by their internal audit department to DFSD, SBP BSC within 15 working days after the end of respective quarter for payment of mark-up subsidy.

In case of Tier 1, DFSD, SBP BSC shall process the mark-up subsidy claims of WLs/EAs on the basis of certificate of verification of external audit firm. However, DFSD shall apply a sanity check on each claim to maintain consistency of each claim payment. Sanity check means that claims do not contain illogical mistakes or are not based on invalid assumptions. Moreover, in case of Tier 2 & Tier 3, DFSD, SBP BSC shall scrutinize subsidy claims of EAs within 15 days after receipt of complete information from EAs. DFSD shall ascertain that calculations of EAs’ subsidy claims with respect to applicable KIBOR are correct.

DFSD shall submit scrutinized claims to the Finance Division for release of funds. Finance Division shall issue sanction letter for release of funds through AGPR within 15 working days on receipt of scrutinized claims from DFSD.

After receiving funds from GOP, DFSD will advise SBP BSC, Karachi for crediting the subsidy amount in respective WL’s account maintained at SBP BSC Karachi. The SBP BSC Karachi Office shall make disbursement of subsidy as per advice of DFSD within two working days from the date of receipt of advice for the same. WLs shall retain their own mark-up subsidy amount and shall credit the remaining amount of subsidy in the accounts of claimant EAs on the same day.

Mechanism for payment of credit loss subsidy by Government

On behalf of Government of Pakistan, payment of credit loss subsidy to EAs will be made on the disbursed portfolio under the scheme on quarterly basis through DFSD, SBP BSC Head Office Karachi.

WLs shall only be eligible to claim 40% pari-passu government guarantee when their respective EAs will declare the default or file bankruptcy/ insolvency and recovery is no more possible from respective EAs.

EAs under Tier 1 will be eligible to claim 10% government guarantee on first loss basis on the disbursed portfolio when their loans are classified as “loss” as per the Prudential Regulations (PR) of SBP for Microfinance Banks i.e. regulations related to classification of loans in “Loss” category would be the benchmark for this purpose and presently it is 180 days. However, in case of EAs regulated by SECP, NonBanking Finance Companies & Notified Entities Regulations, 2008 of SECP shall apply.

In case of Tier 1, EAs shall prepare and submit their credit loss claims to WLs within 05 working days after the end of respective quarter. WLs shall also prepare their own credit loss claims in case of default of MFP and will arrange audit of both claims from External Audit Firm. The audited claims of EAs/WLs along with a certificate from external auditor relating to accuracy of subsidy & loan loss calculations shall be submitted through WLs to DFSD within 15 working days after the end of respective quarter for payment of credit loss subsidy claims.

Moreover, in case of Tier 2 and Tier 3, credit loss subsidy will be paid on loans being classified in “Loss” category as per SBP Prudential Regulations for SME and Agriculture Financing. However, in such cases, where EAs have received credit loss subsidy against NPLs, the subsidy claimed will be returned to DFSD, SBP BSC or the same will be adjusted by EAs by netting it off from the next quarter credit loss subsidy claim.

In case of Tier 2 and Tier 3, EAs shall submit their subsidy claims on the prescribed format to DFSD duly vetted by their internal audit department within 15 working days after the end of respective quarter for payment of credit loss subsidy.

DFSD shall apply sanity check on EAs claims under Tier 1 and scrutinize EAs claims under Tier 2 and Tier 3 within 15 days after receipt of complete information from EAs. Thereafter DFSD will submit claims to the Finance Division, GOP for release of funds. Finance Division shall issue sanction letter for release of funds through AGPR within 15 working days on receipt of scrutinized claims from DFSD. After receiving funds from GOP, DFSD will advise SBP BSC, Karachi for crediting the subsidy amount in respective WL’s account maintained at SBP BSC Karachi. The SBP BSC Karachi Office shall make disbursement of subsidy as per the advice of DFSD within two working days from the date of receipt of advice for the same. WLs after retaining their own credit loss subsidy amount, if any, shall credit the remaining amount of subsidy in the accounts of claimant EAs on the same day.

Role of Banking Supervision Group, SBP

Banking Supervision Departments of SBP, during regular inspection of the EAs, shall conduct inspection of their PMYB&ALS portfolio on sampling basis using their own sampling techniques. SBP inspectors shall randomly select credit files and review them from the perspective of eligibility of borrowers under the scheme, status of loan (regular or NPL) and GOP subsidy claim. The relevant portion of the BSD inspection report on PMYB&ALS will be shared with SH&SFD, SBP and DFSD, SBP BSC.