Karachi December 2 2022: Pakistan’s central bank said it made the payment for a $1 billion bond on Friday, dodging the risk of a near-term default even as worries linger over its ability to pay its long-term debt.

The nation transferred the payment on the sukuk dollar bonds due Dec. 5 three days before its maturity to Citigroup Inc., which will distribute the funds onward to creditors, said Abid Qamar, a spokesperson at State Bank of Pakistan. The notes climbed to 98.9 cents on the dollar Friday, marking a nearly 16-cent comeback from a record low of 83 cents in October, according to indicative pricing data compiled by Bloomberg.

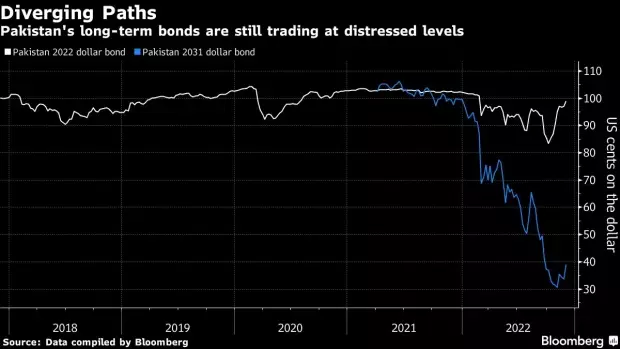

While Pakistan is expected to meet its short-term debt obligations, its longer-term bonds are still trading at distressed levels as investors worry over its ability to emerge from a crisis. Moody’s Investors Service and Fitch Ratings downgraded the nation deeper into junk in October after devastating floods jeopardized its fiscal health.

Talks with the International Monetary Fund for the next loan tranche have also been delayed as the nation evaluates how much the rebuilding will cost. Pakistan needs to repay about $25 billion in the year started July, though most of it has been rolled over or paid, State Bank of Pakistan Governor Jameel Ahmad has said.