Singapore November 10 2022: Traders are laser focused on Thursday’s key US consumer price figures, but inflation data a day later may be even more important in determining the near-term outlook for global markets.

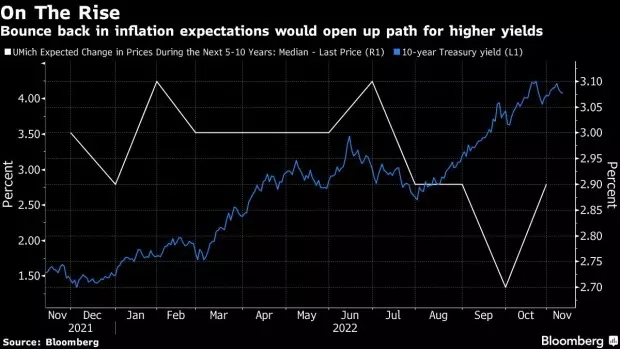

While an expected fall in CPI will likely be welcomed by investors, Friday’s University of Michigan 5-10 year inflation expectations will resonate with Federal Reserve officials fearful of price rises becoming entrenched. The index rebounded to 2.9% in October and a further increase may put further pressure on them to raise rates even higher than expected, weighing on assets from stocks to bonds.

In a speech Thursday, Richmond Fed President Thomas Barkin vowed the central bank wouldn’t back off, saying the “slow return to normal levels of inflation could threaten the stability of inflation expectations.”

US yields could push higher if CPI matches forecasts and 5-10 year inflation expectations rise toward their highest since 2011, according to Prashant Newnaha, senior Asia-Pacific rates strategist at TD Securities Inc. in Singapore.

“A CPI print at expectations should not provoke a significant market response, but a retest of the January and June highs on University of Michigan data would reaffirm that rate hikes to date have not had the intended impact in making a dent on inflation,” he said.