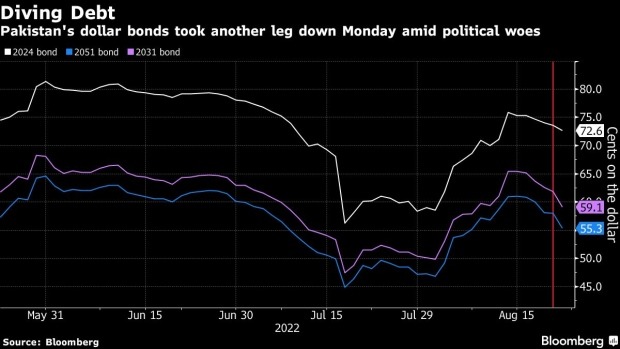

Islamabad August 22 2022: Pakistan’s dollar-denominated bonds took a hit Monday along with its currency and stocks after the government said it is considering legal action against former President Imran Khan.

Securities due April 2024 fell, widening their yield premium over equivalent US Treasuries by more than 92 basis points to 2,825, according to indicative pricing data collected by Bloomberg. Spreads on other notes, including 2031 and and 2051 debt issued just last year, also widened, though they remain well inside their highs of July. The rupee fell 0.9% to 216.66 per dollar, according to central bank data.

The political drama threatens to undermine Pakistan’s quest to convince the International Monetary Fund to release $1.2 billion in financing at a board meeting later this month. The country has already secured $4 billion in pledges from friendly nations like Saudi Arabia, Qatar and the United Arab Emirates to fill its financing gap as it deals with faltering foreign-currency reserves and one of Asia’s fastest-inflation rates.

“Pakistan assets (eurobonds and equities) are unquestionably cheap,” Tellimer strategist Hasnain Malik wrote in a note Monday. “But there is little prospect of getting any help from a drop in domestic political temperature any time soon.”

During a press briefing on Sunday, Interior Minister Rana Sanaullah said a speech by the former premier continued a trend by Khan of targeting the army, judiciary and police and was meant to threaten officials and prevent them from from carrying out their duty.

Pakistan’s politics is heating up ahead of an election that must be held by next year. Khan has agitated for early polls since his ouster earlier this year, betting that voters support his contention that Prime Minister Shehbaz Sharifand and the Pakistani military conspired with the US to remove him from power -- an allegation all three have denied.

Meanwhile, the country’s central bank announced Monday that it was keeping its lending rate unchanged at 15%, in line with the expectations of analysts surveyed by Bloomberg.

Related Posts