New York July 6 2022: For much of 2022, oil steadily rallied as investors piled into bets that the world’s most liquid commodity would surge as inflation climbed. On Tuesday, the trade showed its clearest signs yet of unraveling.

Brent futures plunged by more than $10 a barrel, succumbing to the third-largest daily retreat on record. West Texas Intermediate fell below $100 for the first time since May 11. Prices slumped again on Wednesday.

Months of dwindling liquidity, alongside technical selling, and some producer hedging contributed to the slide. But the real driver was concern about a recession and aggressive interest rate hikes, undermining the idea of oil prices being a means of hedging against inflation.

“Recession fears likely pushed some investors out of the oil trade as inflation hedge,” said Giovanni Staunovo, an analyst at UBS Group AG.

Physical Holding

There has been no violent change for the worse in parts of the oil market that traders watch closely for clues on supply and demand. And there are significant disruptions to shipments, with Libya’s output plunging and Kazakhstan’s exports at risk.

Timespreads -- how much traders will pay to get barrels more immediately -- continue to trade near records, suggesting an urgent demand and tight supplies.

Physical barrels are still fetching huge premiums over their benchmarks, to such an extent that Saudi Arabia lifted its prices to Europe to a record just hours before the plunge in futures.

Prices of diesel and gasoline are also well above crude, giving refineries a big incentive to buy barrels.

Volatility Shift

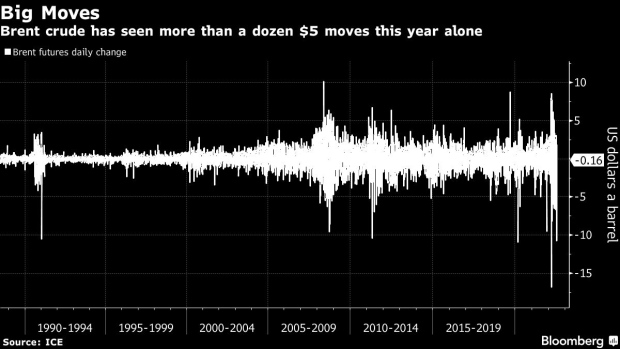

Tuesday’s plunge was part of a pattern of extreme volatility since Russia invaded Ukraine.

Between 1988 and the end of 2020, Brent futures shed more than $10 a barrel on only three occasions. They’ve done it twice since March, during which time there have been more than a dozen $5 a barrel moves. The Bloomberg Dollar Spot index hit the highest since March 2020 on Tuesday.

The volatility has been spurred by a plunge in trader activity. Open interest across the main oil contracts has fallen to the lowest level since 2015, pointing to a growing number of people sitting on the sidelines. This also means the market could be susceptible to sustained large swings going forward, dealers said.

Some bulls had already turned their backs on oil. Before Tuesday’s selloff, Brent was down about 10% from its June high in June. It’s a downward trend that has caused technical traders to pounce, helping to force it lower still.

The global benchmark is trading below its 50- and 100-day moving averages, while its 5-day and 100-day markers formed a bearish crossover pattern this week. In US crude, breakdown of support levels around $105.50 was followed by a snowball effect as prices pierced through more key levels at $103 and $101, said Fawad Razaqzada, market analyst at City Index.

“The move lower was then exacerbated by technical factors and trend-following CTA flows,” Goldman Sachs Group Inc. analysts including Damien Courvalin wrote in a note to clients, referring to systematic traders known as commodity trading advisers. “We believe this move has overshot.”

It wasn’t just nearby prices caught in the selloff though -- crude crashed all the way along the futures curve. Brent for December 2023, shed 8.8% to trade at its lowest level since March, almost as much as nearby prices.

Traders and brokers interpreted the slide as a sign that some oil producers have been selling longer-dated contracts to hedge their supplies, though volumes so far have been small. Such flows can often compound the pressure on nearby futures.

In another sign that the inflation trade is unraveling, cross commodity exchange traded products have now posted two consecutive months of withdrawals -- a stark reversal from huge inflows earlier this year. One such fund reported a 625 million euro ($636 million) outflow on Friday, its largest on record.

“I thought commodity prices were going to send us into a recession, rather them be a victim of it,” said Scott Shelton, energy specialist at ICAP. “Drawdowns from longs were just too extensive for people to stay long, and this forced liquidation.”

Related Posts