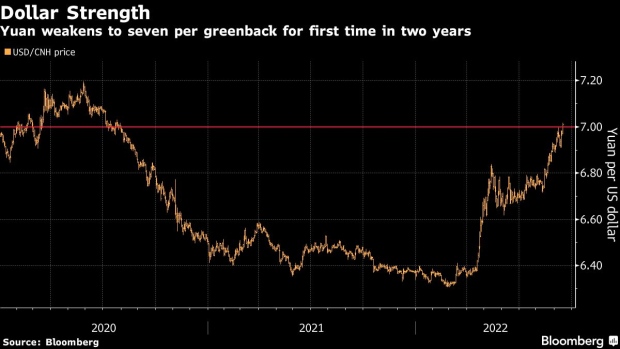

Beijing September 15 2022: China’s yuan weakened past the key 7 per dollar level for the first time in more than two years as a fragile economy and strength in the greenback weighed on the currency, reported by Bloomberg.

The offshore yuan fell as much as 0.7% to 7.0186 per dollar, the lowest since July 2020. That was spurred by a rally in the greenback at the start of New York trading, as the latest US inflation data fuels bets for a large Federal Reserve rate hike this month that would further widen China’s monetary-policy gap with the US and drive outflows. The currency is also under pressure as Covid lockdowns and slowing exports growth hurt the economy.

“The yield differential is expected to widen further given a more hawkish Fed,” at a time when the People’s Bank of China has been cutting rates in the face of an economic slowdown, said Tommy Xie, a Singapore-based economist at OCBC Bank.

Other factors that would continue to weigh on the yuan included bearish sentiment on China’s recovery hopes due to its Covid zero strategy, and renewed concerns about global recession, he said.

While the People’s Bank of China has set a string of stronger-than-expected yuan fixings and reduced the foreign-currency reserve ratio for banks to stem the currency’s losses, it’s merely slowed the decline. PBOC Deputy Governor Liu Guoqiang said in early September that China was able to maintain the yuan at a stable level and that it would be a “norm” in the short term for the Chinese currency to move in two ways.

Still, a rise in Treasury yields has widened the yield spread between 10-year US and Chinese government bonds to the most since 2009 and raised the risk that the inflows to China’s bonds seen in July could be fleeting.

The last time the yuan weakened past 7 per dollar was at the start of the Covid outbreak in early 2020, and before that in August 2019 during the trade war with the US. On trade-weighted terms though, according to the CFETS RMB Index, the yuan is just about where it was at the end of December, which some analysts see as relatively expensive against its non-dollar peers.

Related Posts