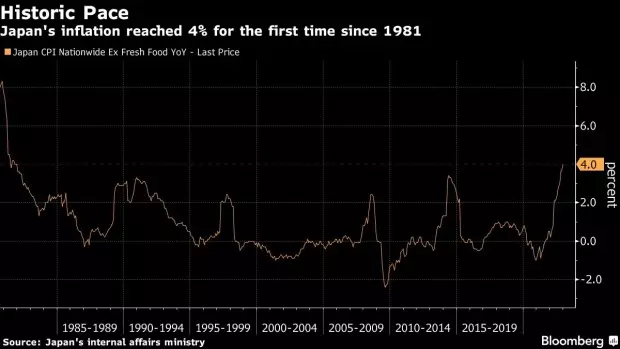

Tokyo January 20 2023: Japan’s inflation hit 4% for the first time in more than four decades, an outcome likely to keep speculation of a monetary policy change smoldering as prices grow at twice the pace targeted by the Bank of Japan.

Consumer prices excluding fresh food rose 4% in December from a year ago, the internal affairs ministry reported Friday.

The result matched economists’ estimate, and was led by further gains in energy and food costs. Processed food prices grew at the fastest pace since 1976, while electricity and gas prices both continued to jump more than 20% from the year before.

While the strongest price gains since 1981 are likely to keep some speculators expecting the possibility of a near-term policy pivot at the BOJ, the outcome was largely in line with expectations among economists and the central bank.

Economists say the result won’t budge Governor Haruhiko Kuroda’s view that the inflationary trend is set to cool. A slowdown in prices is also expected by economists given that government subsidies will sharply lower energy costs in the coming months. Either the December or January inflation figure is likely to be the peak, they say.

“Kuroda has a few more months to go and the BOJ will stick to the current policy framework,” said Toru Suehiro, chief economist at Daiwa Securities. “But that wouldn’t rule out the possibility of policy change entirely.”

The central bank released its updated price outlook after Wednesday’s policy meeting, raising its inflation view for the current fiscal year to 3%, while keeping those for the next two years below 2%.

Still, the drawn-out price hikes add to concerns that the central bank may have underestimated the strength of inflationary momentum, a factor that invites speculation it may reconsider its policy direction down the line.

Economists have brought forward their expectations of policy change at the bank to coincide with the first or second meeting of a new governor set to succeed Kuroda in April. Market watchers say change could still come before then.

“This will likely shape expectations of further moves away from ultra-accommodation by the BOJ,” said Jeff Ng, a strategist at MUFG Bank Ltd., commenting on the December data.

The latest release showed core inflation excluding energy also hit 3% for the first time since 1991, reflecting how far price gains have spread beyond oil and gas.

That trend has also been putting pressure on businesses. More than 300 Japanese firms went bankrupt last year as costs rose, a Teikoku Databank survey showed. Soaring purchase prices and difficulty passing on those costs to customers have increasingly driven companies into bankruptcy, the survey suggested.

The pressure from rising costs may make it harder for companies to make the kind of wage gains the BOJ says it needs to see before moving toward policy normalization.

“I wonder if it is really possible to raise wages under these circumstances, particularly for small and medium-sized enterprises,” said Takeshi Minami, an economist at Norinchukin Research Institute Co. “Large companies have already gained momentum to hike wages as they have some money, but I think it will be tough for smaller companies.”

Still, Prime Minister Fumio Kishida’s economic stimulus package, worth 39 trillion yen ($303 billion) in fiscal spending, is likely to start having an impact early this year. The package includes a variety of anti-inflationary measures, including subsidies aimed at lowering household electricity bills by around 20%.

Tepco, the main power provider for the greater Tokyo region and beyond, has already announced February electricity prices showing a 20% drop from January. That indicates that the government subsidies will weaken nationwide inflation figures from February. That data won’t be ready in time for the BOJ’s March policy meeting.

“The key is when the inflationary peak will come,” said Atsushi Takeda, chief economist at Itochu Research Institute. “I expect the movement to pass on costs to peak in January, and for CPI to slow after that.”

Related Posts