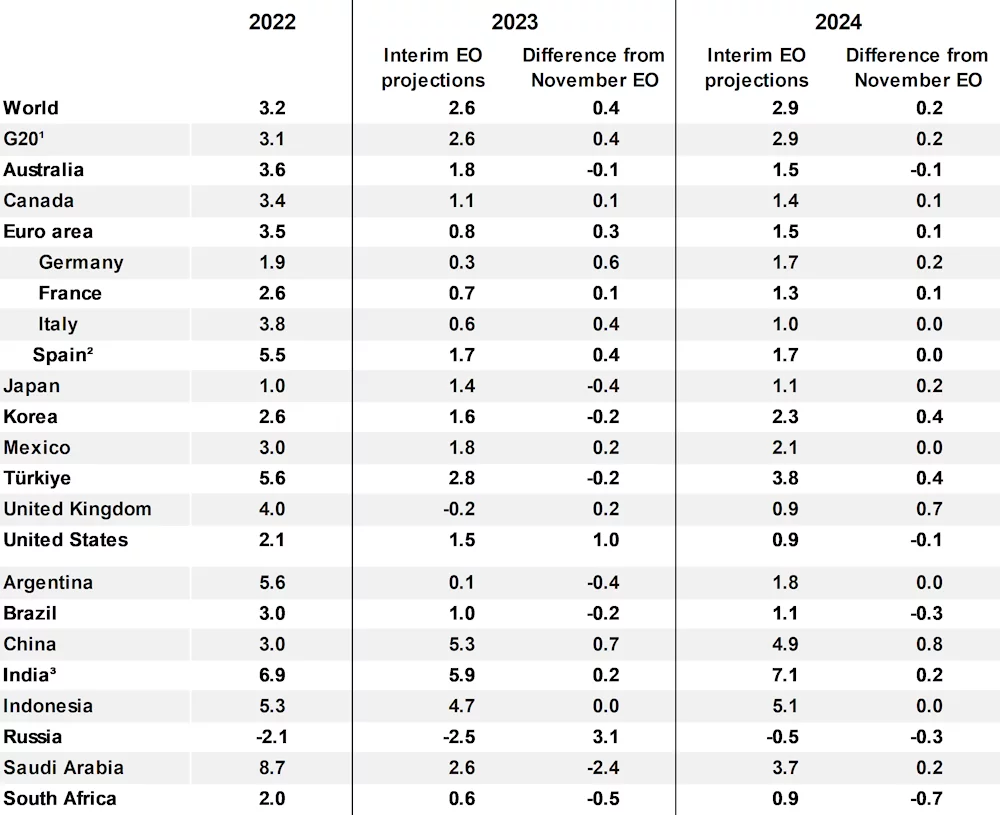

Paris March 18 2023: On the back of improved business and consumer confidence, declining food and energy prices and the re-opening of the Chinese economy, the OECD’s latest Interim Economic Outlook projects global growth to reach 2.6% in 2023 and 2.9% in 2024.

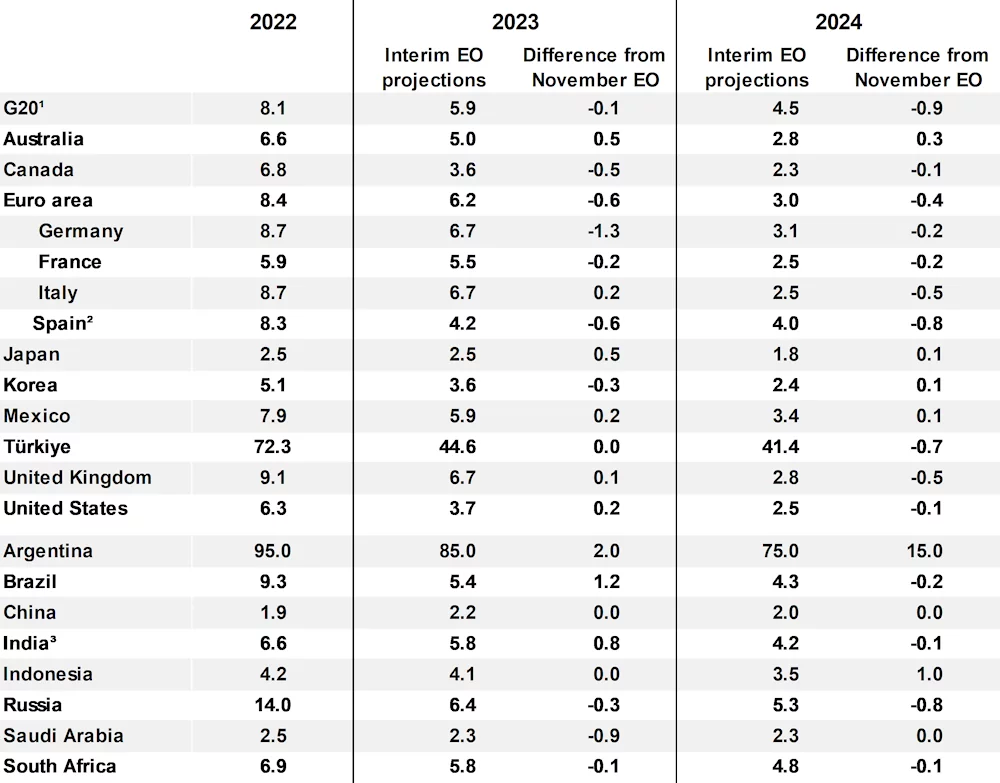

Headline inflation is projected to recede gradually through 2023 in most G20 countries, from 8.1% in 2022 to 5.9% in 2023 and 4.5% in 2024. This is due to tighter monetary policy taking effect, energy prices easing after a mild winter in Europe, and global food prices declining. However, core inflation remains persistent, held up by strong service price increases and cost pressures from tight labour markets. Inflationary pressures will require many central banks to maintain high policy rates well into 2024.

Annual GDP growth in the United States is projected at 1.5% in 2023 and 0.9% in 2024 as monetary policy moderates demand pressures. In the euro area, growth is projected to be 0.8% in 2023, but pick up to 1.5% in 2024 as the drag on incomes from high energy prices recedes. Growth in China is expected to rebound to 5.3% this year and 4.9% in 2024.

“The outlook today is slightly more optimistic than our previous forecasts, though the global economy remains fragile,” OECD Secretary-General Mathias Cormann said. “Some key risks, such as persistent large-scale energy and food market disruptions have been mitigated for now, however the crisis in Ukraine, persistence in services inflation, financial market turbulence, and the steady decline in underlying growth prospects, could be sources of further disruption. More targeted fiscal support and structural reforms to revive productivity growth will be key to optimising the recovery and long-term growth prospects.”

The OECD notes that the improvement in the outlook is at an early stage, and risks remain tilted to the downside. Uncertainty about the course of the war in Ukraine and its broader consequences is a key concern. The overall impact from monetary policy changes is difficult to gauge and could continue to expose financial and banking sector vulnerabilities and make it more difficult for some emerging market economies to service their debts. Pressures in global energy markets could also reappear, leading to renewed price spikes, and higher inflationary pressures. Monetary policy needs to stay the course until there are clear signs that underlying inflationary pressures are lowered durably.

Fiscal support should be prudent and needs to become more focused on those most in need to mitigate the impact of high food and energy prices. Better targeting and a timely reduction in overall support would help to ensure fiscal sustainability, preserve incentives to lower energy use, and limit additional demand stimulus at a time of high inflation.

Rekindling structural reform efforts is needed to revive productivity growth and alleviate supply constraints. Enhancing business dynamism, lowering barriers to cross-border trade and economic migration and fostering flexible and inclusive labour markets would boost competition, mitigate supply shortages and strengthen gains from digitalisation.

Table 1. OECD Interim Economic Outlook forecasts March 2023, Real GDP growth, year-on-year, per cent

Table 2. OECD Interim Economic Outlook forecasts March 2023, Headline inflation, per cent

Related Posts