Beijing October 22, 2021: European natural gas futures fell on speculation that a plunge in Chinese coal prices may temper Asian demand for liquefied natural gas, freeing up more supplies for Europe. In volatile trading, benchmark Dutch gas dropped as much as 6.4%, after earlier rising 1.4%.

Coal futures in China tumbled 11% Thursday as the government sought to reign in speculators, though prices have still more than doubled this year. Chinese authorities recently ordered state energy companies to secure supplies at all costs, exacerbating the fight for LNG between Asia and Europe.

China is pushing miners to ramp up coal production and is increasing imports so that power stations can rebuild stockpiles before the winter heating season, but analysts say shortages are likely to persist for at least another few months.

The state planner, the National Development and Reform Commission (NDRC), said on Tuesday it was studying ways of intervening to lower coal prices and would take all necessary steps to bring them into a reasonable range.

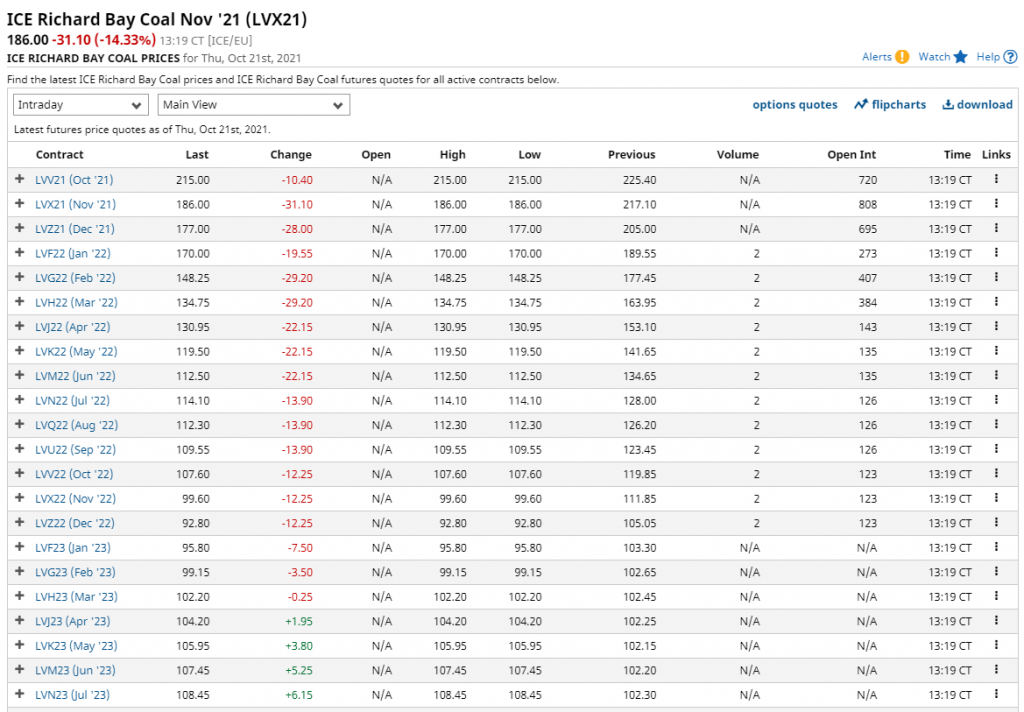

At the start of Thursday's night session on the Zhengzhou Commodity Exchange, the most-active thermal coal futures contract, for delivery in January, plummeted the maximum 14% to 1,365 yuan ($213) per tonne.

That came after the contract finished day-time trade down 11% and brought the overall decline in prices since Tuesday's all-time peak of 1,982 yuan to more than 31%.

“The current drop in coal prices in China -- after the government signaled intervention to increase supply -- could impact the LNG market and ultimately exert a downward pressure on European prices,” Engie EnergyScan said in a note.

Limited gas supply from Russia continues to cause concern, though flows via the key Yamal-Europe pipeline have edged higher, helping to compensate for lower Norwegian shipments. The flows from Yamal still remain well below normal levels.

While benchmark European gas is trading more than 40% below the record reached earlier in October, there’s concern that prices could soar again in the event of a cold winter.

“Any bearish factors – such as improved nuclear power availability in Japan, or removal of voluntary coal restrictions in South Korea - are balanced by limited prompt cargo availability in the event of a cold winter, signs of which have started to appear by unseasonable temperature drops across North Asia,” Rystad Energy AS said in its weekly gas market note.

European gas futures could more than triple to $100 per million British thermal units in a worst-case scenario, Ed Morse, head of commodities research at Citigroup Inc., said in a Bloomberg Television interview Wednesday. Europe could struggle to replenish inventories even if the winter is warm since LNG cargoes and Russian supply may not be sufficient, he said. Europe could see gas prices surge again if the winter proves “really cold,” according to Ed Morse, head of commodities research at Citigroup Inc.

Dutch front-month gas at the Title Transfer Facility fell 6.1% to 87.74 euros a megawatt-hour at 5:22 p.m. in Amsterdam. The U.K. equivalent declined 6.2% to 219.25 pence a therm.

“Asia spot and TTF prices have decoupled from all technical ceilings and are trading at elevated levels well before the peak winter month of January, and in theory could go to any price the next buyer is willing and able to pay,” Rystad Energy’s Senior Gas Markets Analyst Kaushal Ramesh said in the note.

Related Posts